Health Insurance Requirement & U.S. Health Care

What Students Need to Know

The Cost of Medical Care is High in the U.S.

Unlike many countries, the United States does not provide “universal access” or “national health care”. International students are also not eligible for any U.S. federal welfare assistance. When international students receive medical care in the U.S., the doctors and hospitals will look to international students and their insurance companies to get paid for their services.

According to HealthCare.gov, fixing a broken leg can cost up to $7,500, and the average cost of a 3-day hospital stay is around $30,000.

Without insurance, international students might face financial ruin resulting from serious accidents or illness. This could prevent them from completing studies in the U.S.

It is CSU Enrollment Requirement

F-1 International Students

The Board of Trustees of the California State University (CSU) requires F-1 international students to have health insurance as a condition of class registration at SFSU.

J-1 Exchange Students

As per J-1 immigration regulations and the above-mentioned CSU policy, all exchange students on J-1 visas and J-2 dependents must maintain health insurance coverage for the duration of their program as indicated on the Form DS-2019.

The insurance company for the 2025-2026 academic year is United HealthCare.

In some cases, students may be required to pay a “co-pay” to receive a service. Additionally, some non-essential services, such as cosmetic surgery, may not be covered.

F-1 International Students

- F-1 international students are not required to maintain full-time enrollment in the summer session or Winter break.

- Students may purchase the SFSU pre-approved insurance plan through in summer if they enroll in the following Fall semester.

- F-1 international students who are not enrolled in Summer:

- Students who are not enrolled in Summer may choose not to purchase insurance

- The Division of International Education recommends students to purchase some other form of short-term health insurance to protect their health, safety, and financial wellness.

J-1 Exchange Students

- All J-1 exchange students, research scholars on J-1 visas, and J-2 dependents MUST maintain health insurance coverage for the duration of their program as indicated by the dates on their Form DS-2019 (this includes the Summer Term for Calendar Year students).

- Exchange visitors who “willfully fail” to maintain the required health insurance coverage are in violation of their J-1 status and are subject to termination.

Routine (meaning non-emergency) dental and vision care are NOT covered by the SFSU pre-approved insurance plan. Students who would like this coverage should purchase additional dental and/or vision insurance or be prepared to pay for such services privately. Dental and/or vision insurance is not required by SFSU. Students may use other dental and vision insurance services if they wish.

See Voluntary Dental/Vision insurance information at United HealthCare's Student Resources page: https://www.uhcsr.com/voluntary-dentalvision.

See Dental Referrals-Low-Cost Dental Services | Gator Student Health Center

Exceptions

The following students may be exempt from purchasing the SFSU pre-approved insurance plan:

- F-1 international students on government-sponsored scholarships that provide compatible insurance coverage as a part of the sponsorship. Contact f1@sfsu.edu for instructions.

- F-1 international students receiving insurance coverage through an employer-sponsored plan in the United States (i.e., receipt of insurance as part of a spouse's U.S. employment benefits). Contact f1@sfsu.edu for instructions.

- This exception does not apply to F-1 students who are receiving employer-sponsored plans from their CPT employers.

Recommended Reading

- Health Insurance 101 | UnitedHealthcare Student Resources (uhcsr.com)

- Glossary | UnitedHealthcare Student Resources (uhcsr.com)

Video Resources

Visit United HealthCare's student resources page at https://www.uhcsr.com/video.

Students will find short videos on many subjects from Insurance education to a library of Mental Health and Substance Abuse videos, to specific My Account “How to” videos.

Learn How to Use Your Student Insurance

See: Frequently Asked Questions | UnitedHealthcare Student Resources (uhcsr.com)

Purchase Health Insurance

F-1 international students, J-1 exchange students, and J-1 research scholars must purchase and maintain SFSU pre-approved international student health insurance.

Students may purchase additional insurance policies if they wish, but they must purchase the international health insurance plan pre-approved by SFSU regardless.

2025-2026 Plan Summary and Rate

2025-2026 Certificate of Coverage (PDF, 2.77MB)

|

F-1 and J-1 Students |

||||||

|

Term |

Effective Date |

Termination Date |

Student |

Spouse/Domestic Partner |

One Child |

2 or More Children |

|

Special Coverage Period |

8/16/2025 |

5/31/2026 |

$1,380 |

$1,380 |

$1,380 |

$2,760 |

|

Fall 1 |

8/1/2025 |

12/31/2025 |

$731 |

$731 |

$731 |

$1,462 |

|

Fall 2 |

8/16/2025 |

12/31/2025 |

$659 |

$659 |

$659 |

$1,318 |

|

Spring |

1/1/2026 |

5/31/2026 |

$721 |

$721 |

$721 |

$1,442 |

|

Summer |

6/1/2026 |

8/15/2026 |

$363 |

$363 |

$363 |

$726 |

Instructions to Purchase Insurance

Visit United HealthCare’s student portal at http://www.uhcsr.com/sfsu and follow the step-by-step instructions (Word, 2476KB).

Instructions for Setting Up United Healthcare MyAccount After Purchase

- Step-by-Step Instructions (PDF, 161KB) to Access SFSU International Health Insurance Plan on United Healthcare's MyAccount.

- Video instructions (Link to YouTube. Length of video: 3:25)

Video Resources

Watch tutorial videos for purchasing insurance and create an account at https://www.uhcsr.com/video

Students will not receive printed insurance cards by mail.

For the 2025-2026 academic year, students will receive a My Account/ID Card invitation from United HealthCare within 2-3 business days that includes instructions to register and/or sign into your My Account. The ID card will only be available within 30 days of the policy effective date.

Please PRINT and always carry the insurance card.

Insurance Holds and Refunds

Step 1:

Follow the steps above to purchase your insurance plan.

Step 2:

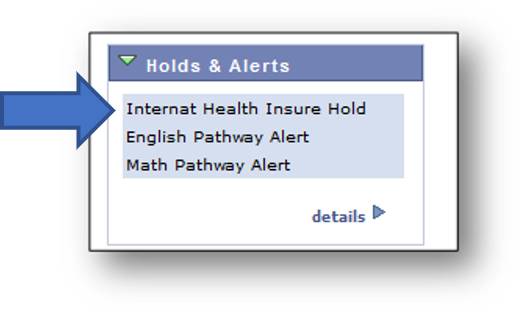

Your “International health insurance hold” will be cleared within 2 business days (excluding weekends) after you purchase the insurance. Please check your student center/SFSU Gateway regularly.

If the hold is not cleared within 2 business days: Forward the confirmation (print as PDF or screen) to f1@sfsu.edu. Feel free to block/cover sensitive information such as your date of birth, bank account number, and bank routing number on the confirmation before emailing it to us.

Refund Process

Students who have filed a claim with their insurance or who submit a refund request after the refund deadline are not eligible for a refund.

Continuing students

- Drop all courses if enrolled (IMPORTANT!)

- Pay off all the outstanding balances showing at the SFSU Gateway/online student center.

- Submit a signed Time Off Request Form (TORF).

- Email f1@sfsu.edu the following information:

- Full name,

- SFSU student ID number

New students

- Drop all courses if enrolled (IMPORTANT!)

- Pay off all the outstanding balances showing at the SFSU Gateway/online student center.

- Understand they will be categorized as a "non-start" student and must re-apply for admissions.

- Email f1@sfsu.edu the following information:

- Full name

- SFSU student ID number

J-1 Exchange Students

Students in the following situations may request a full refund for the insurance fees before the refund deadline. Students should finalize their study plans for the semester before requesting a refund.The 3% administration fee for credit cards is non-refundable.

Request a refund from outside the U.S.

If withdrawing before the exchange program begins

Students must:

- Notify their home university of their intention to withdraw.

- Drop all courses, if enrolled.

- Email exchange@sfsu.edu the following information:

- Full name

- SFSU student ID number

- Confirmation that they have dropped all courses and wish to withdraw from the exchange program.

If switching from in-person to virtual exchange

Students must:

- Drop any in-person/hybrid courses, if enrolled.

- Email exchange@sfsu.edu the following information:

- Full name

- SFSU student ID number

- Confirmation that they have dropped all in-person/hybrid courses and have received permission from their home university to participate in virtual exchange from outside the U.S.

Request a refund after entering the U.S.

If withdrawing from the exchange program

Students must:

- Notify their home university of their intention to withdraw.

- Drop all courses.

- Email exchange@sfsu.edu the following information:

- Full name

- SFSU student ID number

- Confirmation that they plan to withdraw from the exchange program and leave the U.S.

Spring 2026 refund deadline: January 30, 2026

Seeking Medical Care

Gator Student Health Center (GSHC)

Gator Student Health Center (GSHC) provides basic medical care to students who are enrolled at SFSU.

Most GSHC services are covered by the Student Health Fee is included in SFSU tuition and fees.

*For J-1 exchange students it is the tuition paid to a student’s home universities.

GSHC services include:

- Care for sore throats, stomachaches, and coughs

- Care for back and neck pain

- Care for mental health concerns

- Blood tests (e.g. to clear immunization holds)

- General health and medical advice

Not all GSHC services are covered by the Student Health Fee. Certain services are provided "at cost" which means that students must pay but at a lower-than-average price.

Important: GSHC is NOT a walk-in clinic. Before accessing GSHC services, students must first make an appointment. Students can schedule an appointment by following instructions on the GSHC website.

Students will have to pay no-show fees if they do not come to the appointment.

Using Student Health Insurance at GSHC

Students are required to pay for GSHC services first at the Student Center, then file a claim with insurance company to be reimbursed (paid back).

- To pay for the medical services received at GSHC: Log on to the Student Center and make payment, just like how they pay for tuition and fees every semester.

Many off-campus healthcare options are available. Students must understand what each type of healthcare facility offers and when to use them.

Off-Campus Clinics

Students who wish to receive a general medical check-up or non-urgent medical care that is not available at GSHC may make a doctor’s appointment at an off-campus clinic that offers general or specialized medical care for a specific health concern.

To find an off-campus doctors (aka "providers"), go to http://www.uhcsr.com/sfsu

IMPORTANT: Students should NOT go to the Emergency Room unless they have a life-threatening illness or injury.

Urgent Care

Urgent Care is a type of walk-in clinic that treats injuries or illnesses that are non-life-threatening but still require immediate attention (e.g. flu, cold, sprained ankle). Students do not need an appointment to visit an Urgent Care clinic.

Students should visit Urgent Care in the following situations:

- They cannot get an appointment with GSHC but feel that they must see a doctor immediately.

- An Urgent Care clinic is more conveniently located than GSHC.

- The student wishes to receive medical care that is not listed on the GSHC website.

See the below for more details about how to find an Urgent Care clinic.

Emergency Room

The emergency room should ONLY be used for life-threatening situations (such as those that require an ambulance). Students who need to go to the emergency room due to life-threatening injury or illness should call campus police at 415.338.2222 (if on campus) or 911 for help.

Students should NOT visit the emergency room for non-life-threatening situations. If students use the emergency room in a non-emergency situation, their health insurance may not cover the cost of the healthcare that they receive.

For mild to moderate illnesses and injuries, SFSU recommends that students visit Urgent Care or make an appointment with an in-network doctor. Use the Help! I Need Medical Care chart below to learn when to visit the emergency room.

When making an appointment with an off-campus doctor, students should be aware of the difference between “in-network” and “out-of-network” healthcare providers.

An in-network provider is a provider that will accept students’ insurance, while an "out-of-network" provider will not. For this reason, in-network providers are more affordable.

Understanding Health Insurance

To use their insurance properly, students should:

- Get familiar with insurance benefits.

- Try to find an off-campus doctor (aka healthcare provider) and an urgent care clinic. Get an idea of where the healthcare facilities are around you.

- Carry the health insurance ID card with them all the time, especially when attending an appointment or visiting a walk-in clinic.

- If applicable, pay the “co-pay” at the beginning of the appointment. When checking in, students should ask if the healthcare provider will bill the insurance company directly for the remaining cost OR if the student must "file a claim".

- File a claim (if needed).

What is a “co-pay”?

A "co-pay" is a fixed fee that the student must pay for certain services at the beginning of an in-network medical appointment. Insurance will cover the remaining cost. Review the plan summary to learn which medical services have a co-pay.

What is a "deductible"?

A "deductible" is the set amount of money a student must spend on certain medical services before insurance will begin to cover the cost. Once the deductible is met, insurance will cover a percentage of the cost through a process called "coinsurance". Review the plan summary to learn which medical services have a deductible.

What is “coinsurance”?

If a student reaches the deductible limit for a deductible-eligible service, insurance will begin to pay for a percentage of the cost, while the student is responsible for the rest of the cost. This process is referred to as "coinsurance."

While a "co-pay" is a fixed rate for service with no deductible, "coinsurance" is a percentage of the total bill that the students pays after reaching their deductible.

What does it mean to “file a claim”?

Normally, when students use their health insurance to receive medical care, the medical provider will send the bill directly to the insurance company. However, at some locations (for example, Student Health Services at SFSU), the medical clinic will bill the patient. The patient must pay the bill and then "file a claim" with the insurance company to receive a reimbursement, if eligible.

For more details about how to file a claim, see United Healthcare video instructions at https://www.uhcsr.com/video.

Will my health insurance cover a flu shot?

Our plan offers preventative care, including flu shots for in-network providers. SFSU’s Student Health Services offers affordable flu shots periodically during the semester.

What do I say when a healthcare provider asks what kind of insurance I have?

For 2025-2026 academic year your insurance company is United HealthCare.

Who do I contact if I have a question about my coverage or a bill I have received?

For specific questions about medical benefits and claims or support finding an in-network provider, contact United HealthCare enrollment at 1-800-767-0700 or email customerservice@uhcsr.com.

Will my insurance cover “___”?

If a student is not sure what is covered by their health insurance plan, they may contact United HealthCare enrollment at 1-800-767-0700 or email customerservice@uhcsr.com.

Will my insurance cover the care I receive at Gator Student Health Center (GSHC)?

Students who receive bills from GSHC should pay the bill and then file a claim to receive reimbursement, if eligible.

The U.S. health insurance industry uses a lot of confusing vocabulary. Where can I look up terms that I don’t understand?

Contact United HealthCare enrollment at 1-800-767-0700 or email customerservice@uhcsr.com.

Quick Links

Current Students

New Students

Other Resources

Last updated: January 2026

To view PDF files, you'll need Adobe Acrobat 5.0 or above to view it. If you need Adobe Acrobat Reader it's available free from Adobe (link is external).